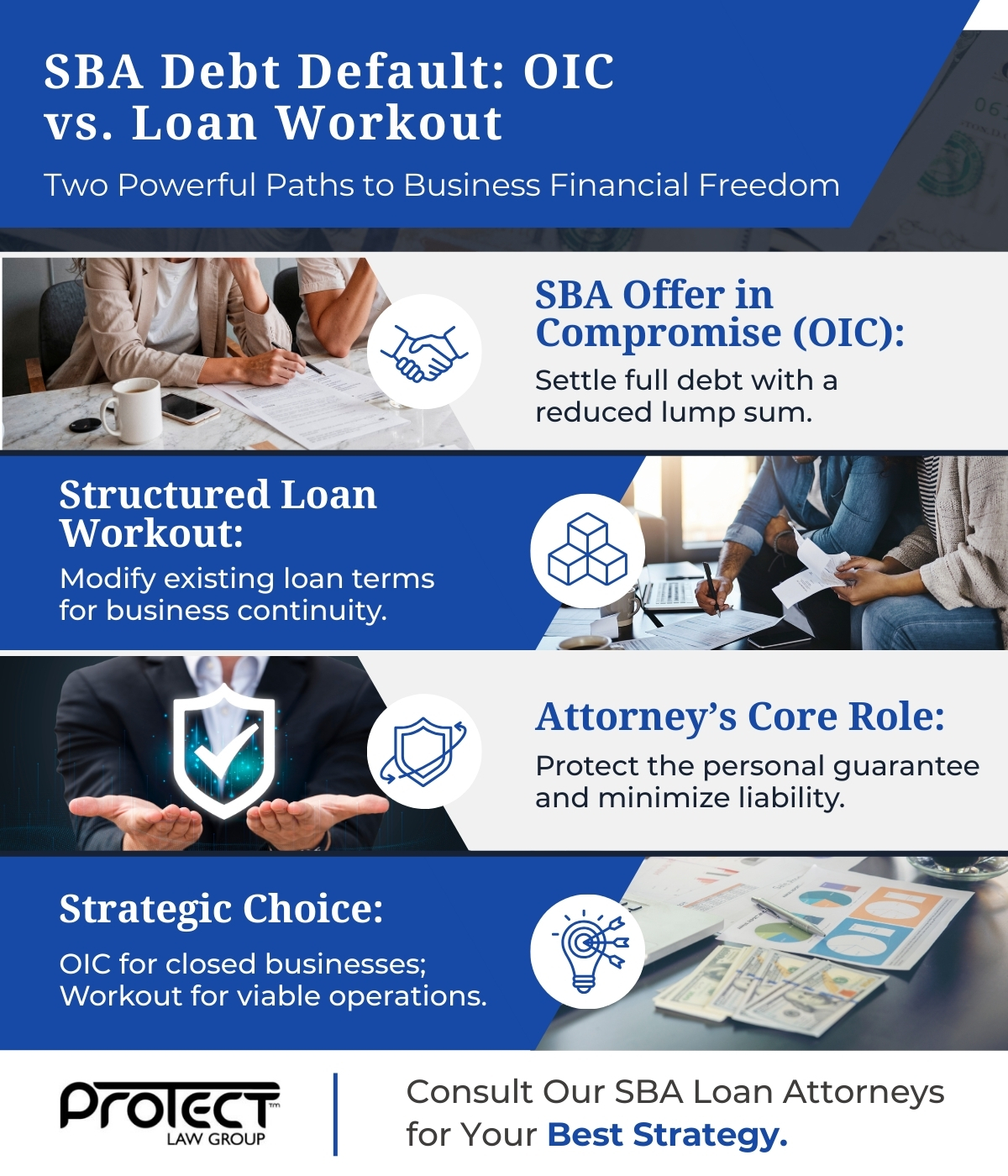

When facing the default of an SBA loan, business owners often feel a profound sense of pressure and uncertainty. Understanding your options is the first step toward reclaiming financial stability and securing lasting business debt relief. For many, the path forward involves either an SBA Offer in Compromise (OIC) or a structured loan workout. As experienced SBA loan attorney professionals, we help you carefully evaluate your situation to choose the strategy that offers the best outcome for your specific SBA debt challenge.

What is an SBA Offer in Compromise (OIC)?

An OIC is a formal settlement proposal where we ask the SBA to accept a reduced, lump-sum payment to satisfy the full debt. We typically use this option when the business has closed and the personal guarantor lacks the financial ability to repay the full amount. Our firm thoroughly prepares the complex financial package required to demonstrate a genuine inability to pay and maximize the potential debt reduction.

The Power of a Structured SBA Loan Workout

A negotiated loan workout is designed to make the existing SBA debt manageable for an ongoing business. This involves modifying the loan's terms, such as extending the maturity date, lowering the interest rate, or temporarily deferring payments. We often pursue this option for viable businesses that simply need breathing room due to temporary hardship. This preserves the business while providing crucial business debt relief.

The Attorney’s Role in Protecting Personal Guarantees

Nearly all SBA loans require a personal guarantee, making the debt a personal financial risk after a default. Our primary role as your SBA loan attorney is to minimize this personal liability, whether through an OIC or a workout. We provide comprehensive protection by defending against aggressive collection actions, including Treasury offsets, ensuring your family’s assets are safeguarded while resolving your SBA debt.

Choosing the Right Strategy for Your Financial Future

Selecting between an OIC and a workout is a case-by-case decision requiring deep knowledge of SBA regulations. An OIC may offer the highest percentage of business debt relief but requires a stringent financial disclosure and business closure. A workout focuses on business continuity. Our expertise lies in analyzing your unique circumstances to determine the most effective and aggressive legal path forward.

If you are struggling with overwhelming SBA debt and need expert guidance, the time to act is now. At Protect Law Group, we have a proven track record of securing favorable outcomes for business owners nationwide. We specialize in navigating the complexities of the SBA and Treasury collection processes to achieve the debt resolution you deserve. Contact us today for a consultation to explore how our SBA loan attorney team can bring you peace of mind and genuine financial freedom.

.jpg)