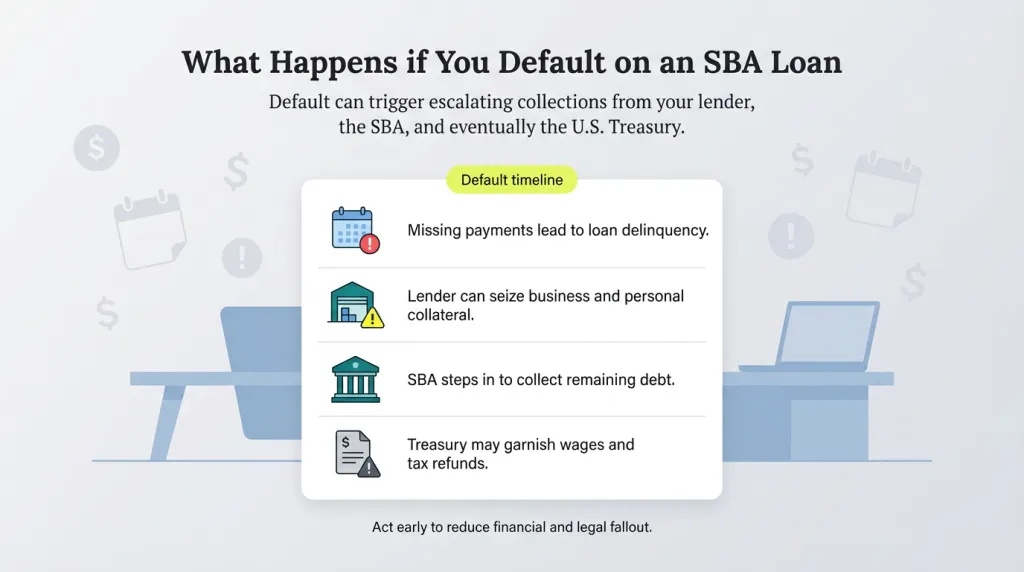

What Is The SBA Office Of Hearings And Appeals (OHA) And What Is Their Jurisdictional Power? CollapseThe Office of Hearings and Appeals (OHA) is an independent office of the Small Business Administration (SBA) established in 1983 to provide an independent, quasi-judicial appeal of certain SBA program decisions. The SBA OHA has authority to conduct proceedings in the following cases: Collection of debts owed to SBA and the United States under the Debt Collection Act of 1982, the Debt Collection Improvement Act of 1996, and part 140 of the aforesaid chapter; (t) Any other hearing, determination, or appeal proceeding referred to OHA by the Administrator of SBA, either through an SOP, Directive, Procedural Notice, or individual request by the Administrator to the SBA/OHA. The SBA OHA’s office is on the eighth floor of SBA headquarters above the Federal Center SW metro stop. Their office address is: 409 Third Street, SW, Eighth FloorWashington, DC 20416

.jpg)

.jpeg)

.jpg)