How the Federal Government Shutdown Affects SBA Loan Borrowers and Guarantors

Book a Consultation CallThe federal government shutdown that began on October 1, 2025, has significantly impacted small businesses nationwide as the U.S. Small Business Administration (SBA) suspended most of its core lending and contracting programs. According to the SBA’s contingency plan, nearly 23% of the agency’s workforce was furloughed. While 4,745 of 6,201 employees were retained, key divisions—including Capital Access, Field Operations, and the Office of General Counsel—experienced sharp reductions.

When headlines announce a federal government shutdown, small business owners and guarantors with SBA loans often ask: “Does this pause my payments or stop collections?” The short answer is no. A shutdown creates administrative delays, but it does not suspend your legal obligations as a borrower or guarantor. At Protect Law Group, we guide clients nationwide through these high-risk situations.

The U.S. Small Business Administration (SBA) relies on annual appropriations for most of its programs. During a lapse in funding:

The Bureau of the Fiscal Service (BFS), part of the U.S. Treasury, is responsible for government-wide debt collection. Its shutdown plan treats debt collection and the Treasury Offset Program (TOP) as “excepted” activities. That means federal loan debts referred to Treasury can still trigger:

Even while SBA is scaled back, Treasury’s enforcement mechanisms remain operational.

For borrowers and personal guarantors, a shutdown means:

If you are a borrower or guarantor:

Q: Do I still have to make my SBA loan payments during a shutdown?

Yes. A government shutdown does not suspend your repayment obligations. Interest and penalties continue to accrue even if SBA staff are furloughed.

Q: Can I apply for a new SBA loan during a shutdown?

No. New 7(a) and 504 loan applications are paused until Congress restores SBA funding. Even lenders with delegated authority cannot approve new loans during the lapse.

Q: What about disaster loans?

SBA disaster loans usually continue, since they are funded separately. However, you may face slower processing times.

Q: Can I request a loan modification, deferment, or reinstatement?

You can submit requests, but most require SBA review. These are considered “non-excepted” functions and will not be processed until the shutdown ends.

Q: Does the government stop collecting on SBA debts during a shutdown?

Not entirely. If your loan has been referred to the Treasury’s Bureau of the Fiscal Service, collections—including tax refund offsets, Social Security offsets, and cross-servicing—will continue.

Q: Will foreclosure or liquidation stop?

Not completely. The SBA can still approve limited liquidation or collateral protection actions if there is risk of “imminent loss” to government assets.

Q: Could the shutdown help me as a guarantor?

In limited ways. You may get a temporary reprieve from new enforcement or settlement negotiations. But once SBA reopens, expect a backlog-driven surge in activity, including possible acceleration of default cases.

Q: What should I do now if I’m behind on payments?

Led by former Georgia Senator (Republican) and the current SBA Administrator, Kelly Loeffler, the SBA website displays a bright red "Special Announcement" message that provides the following:

Senate Democrats voted to block a clean federal funding bill (H.R. 5371), leading to a government shutdown that is preventing the U.S. Small Business Administration (SBA) from serving America’s 36 million small businesses.

Every day that Senate Democrats continue to oppose a clean funding bill, they are stopping an estimated 320 small businesses from accessing $170 million in SBA-guaranteed funding.

As a result of the shutdown, we wanted to notify you that many of our services supporting small businesses are currently unavailable. The agency is executing its Lapse Plan and as soon as the shutdown is over, we are prepared to immediately return to the record-breaking services we were providing under the leadership of the Trump Administration.

If you need disaster assistance, please visit sba.gov/disaster.

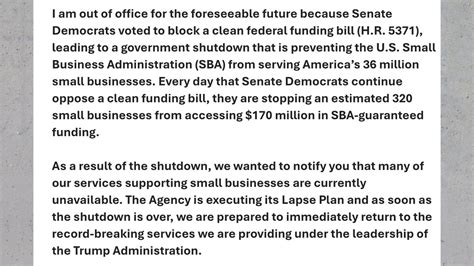

The automatic response emails from several furloughed SBA staffers state the following:

Below is the transcribed text from the furloughed SBA Staffer's email:

“I am out of office for the foreseeable future because Senate Democrats voted to block a clean federal funding bill (H.R. 5371), leading to a government shutdown that is preventing the U.S. Small Business Administration (SBA) from serving America’s 36 million small businesses.”

“Every day that Senate Democrats continue (to) oppose a clean funding bill, they are stopping an estimated 320 small businesses from accessing $170 million in SBA-guaranteed funding.”

“As a result of the shutdown, we wanted to notify you that many of our services supporting small businesses are currently unavailable. The Agency is executing its Lapse Plan and as soon as the shutdown is over, we are prepared to immediately return to the record-breaking services we are providing under the leadership of the Trump Administration.”

The government shutdown does not cancel SBA debt. It creates delays for new loans and discretionary relief, while Treasury’s collection authority remains live. At Protect Law Group, we help business owners and guarantors use this window strategically—preparing defenses and settlement packages so they are ready the moment SBA reopens.

Contact an experienced SBA loan defense attorney immediately.

Our SBA Attorneys have guided thousands of small businesses through reviews, contested or negotiated debts assessed against owners, officers and guarantors, and litigated cases at the SBA Office of Hearings & Appeals (OHA) Court before presiding Administrative Law Judges (ALJs).

Schedule a confidential strategy session today → keep your success story from becoming the next SBA nightmare tale. Contact us at SBA-Attorneys.com for a confidential Case Evaluation.

Sources and links:

SBA employee information for shutdown and furlough

This article is provided for informational purposes only and does not constitute legal advice. Consult a qualified SBA-Attorney for advice regarding your individual situation.

Millions of Dollars in SBA Debts Resolved via Offer in Compromise and Negotiated Repayment Agreements without our Clients filing for Bankruptcy or Facing Home Foreclosure

Millions of Dollars in Treasury Debts Defended Against via AWG Hearings, Treasury Offset Program Resolution, Cross-servicing Disputes, Private Collection Agency Representation, Compromise Offers and Negotiated Repayment Agreements

Our Attorneys are Authorized by the Agency Practice Act to Represent Federal Debtors Nationwide before the SBA, The SBA Office of Hearings and Appeals, the Treasury Department, and the Bureau of Fiscal Service.

Clients personally guaranteed an SBA 7(a) loan that was referred to the Department of Treasury for collection. Treasury claimed our clients owed over $220,000 once it added its statutory collection fees and interest. We were able to negotiate a significant reduction of the total claimed amount from $220,000 to $119,000, saving the clients over $100,000 by arguing for a waiver of the statutory 28%-30% administrative fees and costs.

Clients' 7(a) loan was referred to Treasury's Bureau of Fiscal Service for enforced collection in 2015. They not only personally guaranteed the loan, but also pledged their primary residence as additional collateral. One of the clients filed for Chapter 7 bankruptcy thinking that it would discharge the SBA 7(a) lien encumbering their home. They later discovered that they were mistakenly advised. The Firm was subsequently hired to review their case and defend against a series of collection actions. Eventually, we were able to negotiate a structured workout for $180,000 directly with the SBA, saving them approximately $250,000 (by reducing the default interest rate and removing Treasury's substantial collection fees) and from possible foreclosure.

Client personally guaranteed SBA 7(a) loan balance of over $150,000. Business failed and eventually shut down. SBA then pursued client for the balance. We intervened and was able to present an SBA OIC that was accepted for $30,000.